Motor vehicle dealer surety bonds provide protection for customers, creditors, and governments. Trust between all parties is essential for a motor vehicle dealer. Customers trust that the dealer has told them the truth about the vehicle that they'll use to drive their families around. Sellers and creditors trust that the dealer will pay them back for inventory and financing. State governments trust that dealers will abide by state laws and pay all required taxes. To grow and prosper, a motor vehicle dealer has to earn this trust by ensuring that all relevant third parties are protected in the event of a dispute or violation. Motor vehicle dealer surety bonds provide protection for customers, creditors, and governments. In fact, most state governments require dealerships to obtain motor vehicle dealer bonds before the state will issue a dealership license. A motor vehicle dealer bond (also called an MVD bond, auto dealer bond, car dealer bond, or DMV bond) uses a third-party guarantor to provide a financial guarantee that an auto dealer will operate in compliance with legal and ethical standards. An automobile dealer who needs to obtain a motor vehicle dealer surety bond should know the key facts about these bonds before starting their search. Here we'll cover the basics of how a motor vehicle dealer bond protects a dealer's customers and other important third parties. Then, we'll look at some of the most important types of vehicle dealer bonds and state laws regulating them. Finally, we'll learn about how dealer bonds are priced, and how you can get one.

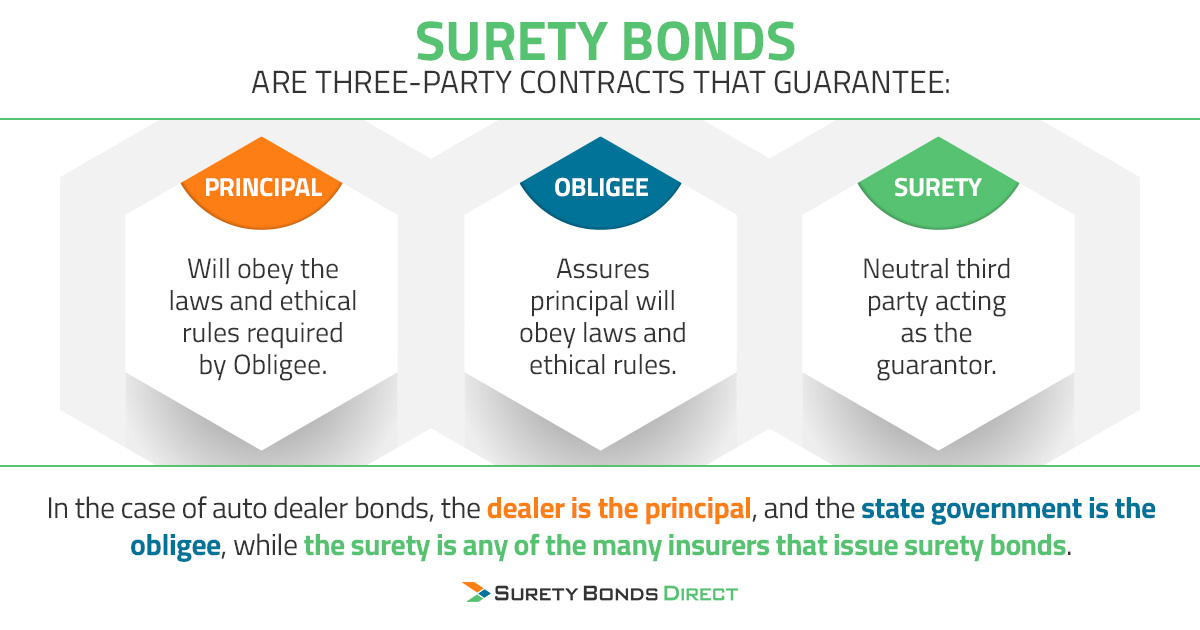

Watch our video explaining what an auto dealer bond is, when it's required, and why it's required. A motor vehicle dealer bond is a type of surety bond. Surety bonds are three-party contracts guaranteeing that one party (called the principal) will obey the laws and ethical rules required by another party (called the obligee), with a neutral third party (called the surety) acting as a guarantor. In the case of auto dealer bonds, the dealer is the principal, and the state government (usually the Department of Motor Vehicles or the Secretary of State) is the obligee, while the surety is any of the many insurers that issue surety bonds. Unlike other types of insurance that a dealer might carry, a surety bond protects third parties such as customers and creditors rather than the dealer. If a third party believes that a vehicle dealer has failed to act legally and ethically, that party can file a claim with the surety that issued the dealer's bond. The parties who can typically file a claim under a dealer bond include:

Common reasons for which a third party can file a claim include:

Most states offer searchable online databases of licensed dealers so that anyone can verify that a dealer is licensed and bonded before they visit the lot or buy a vehicle.

The claims process for a motor vehicle dealer bond is made up of escalating stages. Typically, a party with a complaint (the claimant) will contact the dealer first. The dealer should immediately investigate the complaint and work to negotiate a solution with the claimant. In the event that the dealer and the claimant can't reach an agreement, the claimant can contact the surety that issued the dealer's bond and file a claim against the bond.

Once the claim has been filed, the surety will reach out to both the dealer and the claimant to understand each party's side of the story. The surety will then investigate and decide whether the claim is valid. If the surety decides, after investigation, that the claim is not valid, the surety will close the investigation without further action. If the surety decides that the claim is valid, the surety will pay out the claim amount to the claimant, up to the amount of the bond. The dealer must then repay the surety for any money paid out.

The best starting point for researching which kind of dealer bonds a dealership needs is to determine which type of dealership it is, and then look up the individual state's specific bond laws. Each of the many types of motor vehicle dealership can require its own types of surety bond, depending on what state it operates in:

Each state has substantially different laws governing which type of surety bonds a vehicle dealer needs. Thus, for anyone interested in becoming a vehicle dealer, it's important to research the applicable laws in the individual state in which your dealership will operate. To check the laws for your state, see our page on Motor Vehicle Dealer Bonds and click on any state for a quick summary of applicable requirements.

To provide a better picture of the wide scope of surety bond laws that govern motor vehicle dealers, we've assembled a quick list of some oddities in the laws that many dealers miss or don't know about:

Two main factors determine the premiums a dealer will pay for an MVD surety bond:

Note that Surety Bonds Direct can help you obtain a dealer bond even if you don't have great credit. For more information on how a credit score affects a business's surety bond premiums, as well as options for principals with lower credit scores, such as co-signers and premium financing, read our article on How to Get a Surety Bond with Bad Credit.

Obtaining an auto dealer surety bond is a requirement for most people opening a vehicle dealership, but it doesn't have to be a long or stressful process. Surety Bonds Direct works directly with A-rated sureties to get our customers the lowest premiums available on motor vehicle dealer bonds. For more information on our full range of dealer bonds, contact our bond specialists at 1-800-608-9950 or use our easy two-minute surety bond quote request to get your quote today.

Jason O'Leary

published: November 13, 2019Can't find what you're looking for? Let us help!

Get Started » or, if you'd prefer, call us at

(No obligation, takes 2 minutes)

Or Call a Bond Specialist

1-800-608-9950

It's Fast, Free & No-Obligation